Only BlackBull Markets (72 and 90 ms) and Fusion Markets (79 and 77 ms) offered faster execution speeds overall when averaged out. As you can see, IC Markets doesn’t require a minimum deposit to begin trading, nor does the broker charge you to add money to your account. (We dislike that practice and deduct points from brokers that charge this fee when calculating scores.) We also contacted IC directly and confirmed that they don’t charge an inactivity or withdrawal fee. By all means, avoid brokers that register Canadian traders under offshore regulators. If it is not AISC or the FCA, you might fall victim of fraudulent activites.

Which Forex Broker That Accepts Canadian Traders Has The Best Spreads?

Admiral Markets is more of a boutique operator than some of the other ‘mega-brokers’, but that could work to its advantage. Alternatively, you can look on the official CIRO website to see if the broker is listed with them. Additionally, Canadian regulations aim to protect you by ensuring that brokers operate with the strict framework set by CIRO, which might be more stringent than in other countries.

Performance-driven technology and ultra-low spreads

He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. Check out a gallery of screenshots from CMC Markets’ mobile trading app, taken by our research team during our product testing. The entry-level claims of AvaTrade are backed up by its £100 minimum balance on new accounts.

- When analysing trading costs, including spreads and commissions, Fusion Markets stood out as having some of the lowest spreads and cheapest commissions for an MT5 broker.

- Founded in 1989, CMC Markets is a highly trusted, publicly traded brand that holds five Tier-1 licenses regulatory licenses, including the Canadian Investment Regulatory Organization (CIRO).

- We like OANDA because the broker gives you access to a vast range of markets and trading products, including 69 Forex pairs.

- We like the 80 technical indicators and drawing tools that come with TradingView charts which allow you to create your custom templates.

How To Check Broker Is CIRO Regulated

The web-based tutorials are also of very high quality and cover a wide range of topics, ranging from ‘How to get started’ to ‘Advanced Risk Management’. The stocks and futures offered by Pepperstone’s MT5 platform forex broker listing allow its clients to hedge forex positions, or even take out stand-alone positions in other assets. Something worth considering if you are looking to iron out some volatility in your P&L performance.

Best Forex Brokers in Canada for 2024

CMC Markets also delivers some of the lowest trading costs in the industry. In our 2024 Annual Awards, CMC Markets finished Best in Class in the Commissions and Fees category thanks to its consistently low spread offering, which is available for all customer segments and account types. Beginner forex traders will appreciate CMC’s wide range of educational resources and MetaTrader enthusiasts can use MT4 plugins from Autochartist and FX Blue. Both the Classic and EDGE trading accounts give you access to the MetaTrader 4 platform, which we think is one of the best platforms and is especially beneficial if you are a scalper. TMGM’s ECN execution model delivers fast execution speeds on MT4, which allows you to enter and exit your trades faster while reducing slippage. With BDSwiss, you can access the MT5 and MT4 trading platforms, as well as the broker’s own proprietary mobile trading app and web platform.

This allows you to use MetaTrader 4’s one-click function to take advantage of these low spreads. Being CIRO-regulated means brokers are legally approved to accept clients within Canada and that the broker complies with the regulatory requirements set by the terms and conditions of their CIRO licence. Forex brokers that accept Canadian clients are either based in Canada and are CIRO-regulated or based offshore.

– Most Trusted Forex Broker Accepting Canadian Clients

Of all the ASIC-regulated brokers, Fusion Markets came out on top with a commission of AUD $4.50 round turn per standard lot, which is $2.50 less than the industry standard of $7. And while the commission cost is definitely a cost to consider, it is only good if the spreads remain competitive, which we have proven in our tests. Canada MT5 traders should fully understand and make use of Stop Loss and Limit Order trading features available on Canada MT5 trading platforms. Trading costs play a huge role in your profitability while trading currency pairs. Friedberg Direct stands out by offering you the ability to trade forex using fixed spreads (with zero commissions).

From our extensive analysis, the table below highlights that Eightcap offers the largest crypto range against other brokers by some margin. This high leverage is possible because the broker operates out of New Zealand, where the regulations are less restrictive than ASIC-supervised brokers. For traders keen on maximising their exposure while using MT5, BlackBull Markets is an undeniable frontrunner. When logged into your Live account in the Canada MT5 desktop app, go to the “File” dropdown menu where you will see a “Deposit” and “Withdrawal” buttons. For Canada MT5 stock traders who intend to keep onto their stocks for an extended period of time, it is important to examine if they are suited for dividend reinvestment.

FxPro.com is another MT5 broker with excellent trading conditions and low spreads. If you’re unsure where to start, why not open an account with up to 2 brokers reviewed in this guide. This will allow you to test-drive their service and assess their platform in a live trading environment.

After opening a live account with FP Marktes, I found that the live spread for EUR/USD on the commission-free Standard Account was around the industry average of 1.15 pips during the London session. You can also choose to trade from a raw spread account, which will offer lower spreads but charge a commission per trade of $3.00 per lot, per side, which is better than the industry average of $3.50. A quick look and I can see they specialise in the MT5 trading platform with RAW spreads from 0.o pips with their ECN account but you will need a hefty $5000 minimum deposit to use it.

We recommend CMC Markets for its impressive range of 330+ currency pairs, giving you a better range of volatile pairs to trade that most brokers don’t offer. This lets you find more opportunities to find trades that suit your strategy, especially if you day trade. Additionally, the broker provides the MT5 platform, which enhances your trading experience with faster execution and a broader range of tools, including more indicators.

The broker also had the lowest average spreads compared to any other fixed-spread broker, averaging 1.4 pips across the major currency pairs. Canadian traders looking to use fixed spreads for their trading should turn to Friedberg Direct, powered by AvaTrade. AvaTrade is a reputable forex and CFD broker running the Friedberg Direct trading platform technology. Friedberg Direct was founded in 1971 and forms one of the largest independent brokers in Canada.

The Canada funds withdrawal process involves several stages including inputting your account information and choosing the type of withdrawal method. In many cases, the ‘Withdraw’ function is found under your Canada MT5 account funding option dashboard. While some will argue the best platform, version 4 or 5, it really just comes down to the trader preference. A quick one; this service is not free so make sure you have enough money in your account for subscription fees.

Many of the brokers listed above will also offer extra plugins and tools for the MetaTrader 5 platform. These are only available on the desktop version but will provide much value for more active traders. The broker offers commission-free trading (except for Share CFDs and indices) and floating spreads from 0.5 pips. This combination is better than the industry average and is particularly suitable for high-frequency trading. ActivTrades integrates the standard suites of MetaTrader 4 and 5 and offers its proprietary ActivTrader.

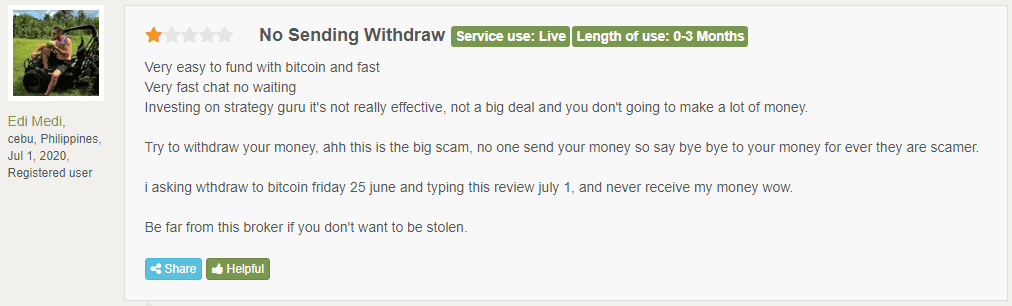

These brokers follow strict rules to protect you, ensure your money is safe, and ensure fair trading practices. Always check a broker’s regulatory status and https://forexbroker-listing.com/ look for reviews or feedback from other traders before you start trading. With the broker’s Zero account, you will be charged CAD $6 per lot, round-turn.

The broker offers competitive spreads of two pips on EUR/USD with no commission, which is low compared to its peers. This combination of trust and transparent pricing makes OANDA a solid choice, especially if you value a straightforward, dependable trading partner without hidden costs. Canadian clients can choose a broker with CIRO regulation or consider a handful of replicable offshore forex brokers. We have compared both types of brokers and made 2024 recommendations based on different trader needs. Our live fee test during the London and New York trading session from the Advantage account showed an average spread of 2.0 pips. This is higher than the industry average of 1.08 pips for a commission-free account.