For equity crowdfunding, platforms like Republic, CircleUp and Fundable are all viable options. If you’re looking for angel investors, sites like Angel Capital Association and AngelList can connect you with accredited angel investors. Most SBA loans are issued by banks, credit unions and other financial institutions. Similar to bank loans, you can start your search for an SBA loan with a lender you’ve previously worked with, or a local bank in your community.

Pick a method of accounting

An experienced accountant or tax consultant can not only ensure compliance but can proactively recommend strategies to reduce tax liability. In an increasingly digital age, crowdfunding platforms like Kickstarter or Indiegogo have emerged as viable financing avenues. A contemporary twist to the traditional lending model, peer-to-peer (P2P) platforms connect borrowers directly with individual lenders or investor groups.

We and our partners process data to provide:

The AI identifies peak sales times, popular menu items and customer preferences. It then generates targeted marketing campaigns, such as personalized email offers and social media promotions, aimed at different customer segments. For example, the AI suggests a discount campaign on popular items during off-peak hours to boost sales. It also creates personalized loyalty programs to retain frequent customers.

Best for Business Lines of Credit

Nonprofits that focus on microloans can also be an option to fund a new business venture. Interest rates for commercial real estate loans are generally lower than other forms of financing, ranging from 5% to 15%. Neighborhood banks offer the best rates on business loans—but usually for borrowers with years in the business game and good credit. Two of the most common ways you can receive and access your business funds are through a lump-sum payment or on an as-needed basis. If you want to receive your funds up front, choose a traditional working capital or term loan. However, if you want to use funds only as you need them, consider a business line of credit.

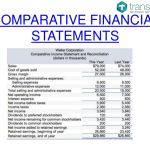

Accrual basis accounting is more complex because it tracks revenue when earned and expenses when incurred, regardless of when cash changes hands. The profit and loss statement, also known as the income statement, shows your business’s revenues, expenses and profit or loss over a period of time — usually a month, quarter or year. As a small business owner, you may pay yourself last or even forgo a paycheck entirely to conserve cash and put more money back into growing the business.

- This makes it a versatile tool, especially for managing cash flow fluctuations or unexpected expenses.

- And since it’s a personal lender, not a business lender, Avant doesn’t care about things like your business revenue and business age (as long as you meet other requirements, of course).

- For instance, you might choose to start your fiscal year on July 1 and have it end on June 30 of the following calendar year.

- If you want the most affordable type of debt financing and you have strong qualifications, a bank or SBA loan might be your best option.

This makes crowdfunding a popular option for people who want to produce creative works (like a documentary), or a physical product (like a high-tech cooler). We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research.

Bluevine’s business line of credit requires a high minimum annual revenue and isn’t available in all 50 states. We picked Bluevine for its line of credit which ranges from $5,000 to $250,000 and can be repaid with a weekly or monthly structure. Customers who repay weekly make payments each week over 26 weeks, while customers who repay monthly make payments each month over one year. Small businesses that are required to pay estimated quarterly taxes but fail to do so may be assessed a penalty by the IRS. If you want to retain complete control of your business, but don’t have enough funds to start, consider a small business loan.

Proper accounting for small businesses encompasses a number of important tasks. This program encourages small businesses to engage in federal research and development that has the potential for commercialization. Find out if the SBIR’s competitive awards-based program makes sense for you. Almost all venture capitalists will, at a minimum, want a seat on the board of directors. So be prepared to give up some portion of both control and ownership of your company in exchange for funding.

It’s important to set aside money and look into growth opportunities, which can allow your business to thrive and move in a healthy financial direction. Edgar Collado, chief operating officer at Tobias Financial Advisors, said business owners should always keep an eye on https://www.quickbooks-payroll.org/ the future. With online loans, your business may be able to access funding faster, assuming it’s approved. Here’s how to figure out what business financing options might be best for you. There are many strategies for preparing financial statements for a small business.

Having these documents before you start your financing search will make the process smoother. The application process may be simpler with online lenders who may check credit and/or require you to link your business bank account to verify revenues. When a bank needs collateral to secure a loan, but you don’t want to risk assets, you might want to consider cash flow loans.

On top of that, you need the data used in bookkeeping to file your taxes accurately. A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated https://www.accountingcoaching.online/what-is-accelerated-depreciation/ in the software, making it easy to get accurate debits and credits entered. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google free cash flows Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Her work has been featured on US News and World Report, Business.com and Fit Small Business. She brings practical experience as a business owner and insurance agent to her role as a small business writer.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls. Assets include everything the business owns, from physical items like equipment to intangible assets like patents. The primary advantage of grants is that they don’t need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Fundbox offers flexible qualification requirements, including a minimum time in business of six months and an annual revenue requirement of $100,000. We picked National Funding because it offers robust financing options for small to midsized businesses. Working capital loans are available from $5,000 to $500,000 and also equipment financing up to $150,000. Funding Circle provides long-term loans that are essential for businesses planning significant investments in growth or infrastructure. The clear terms and lower interest rates compared to short-term loans make this an excellent choice for businesses with a stable financial outlook and a strategic long-term development plan. Wells Fargo, with physical branches across the country, offers business lines of credit and term loans.

With a short time in business requirement, low minimum credit score and low annual revenue requirement, Fundbox is best for startups and other newly established businesses. National Funding offers loans from $5,000 to $500,000, but two years is the maximum length for a large loan. I had a client that got excited by what he thought would be a lending source that could do $500k for five years, but the five-year loan was only offered at $100,000. A local banker made a collateralized loan for the large equipment purchase, and the client took a small short-term loan from National Funding to help with cash flow during a tough spot. Bluevine is best for businesses that are looking for a short-term line of credit with flexible repayment options.